Egypt urges auto manufacturers to boost local value-added under revised industry programme

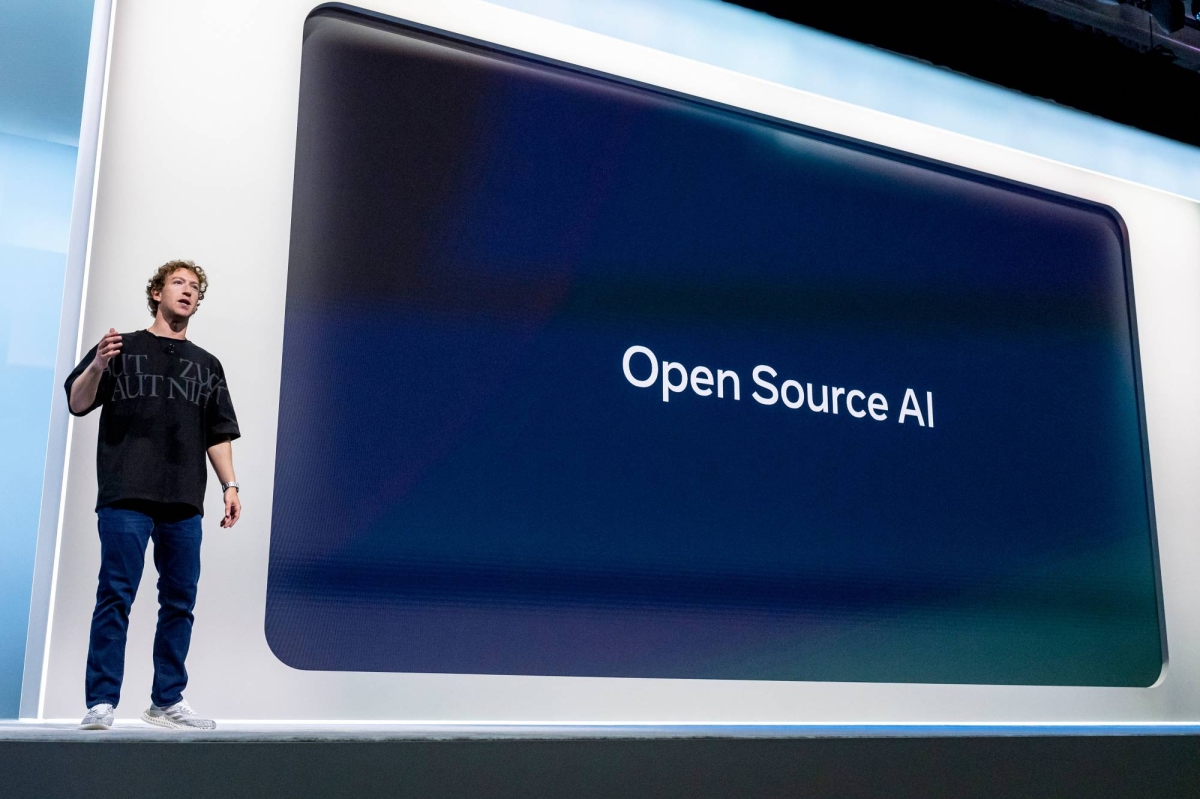

Deputy Prime Minister for Industrial Development and Minister of Industry and Transport, Kamel Al-Wazir, held on Monday an extensive meeting with automotive manufacturers operating in Egypt to review recent amendments to the National Automotive Industry Development Programme (AIDP).

Attending the meeting were the Minister of Investment and Foreign Trade, senior officials from the Ministry of Finance—including the Deputy Minister for Tax Policies—the heads of the Egyptian Tax and Customs Authorities, and members of the programme’s technical committee, alongside representatives from the Ministries of Industry, Investment, Foreign Trade, and Finance.

Opening the meeting, Al-Wazir stressed that the updated programme is designed to provide meaningful incentives to manufacturers and ensure long-term sustainability by adopting a practical and realistic approach. He emphasised the need to enhance local manufacturing to scale up production and fully utilise existing industrial capacities and resources.

The amendments were approved by the Ministerial Group for Industrial Development and the Supreme Council for the Automotive Industry, chaired by the Prime Minister, and were subsequently ratified by the Cabinet. Al-Wazir affirmed the state’s readiness to support automakers in developing this strategic sector for mutual benefit.

He also announced the conclusion of the transitional period on 30 June and instructed the Ministry of Finance to start disbursing entitlements to companies registered under the programme. The revised AIDP officially took effect on 1 July.

The meeting reviewed the criteria for joining the updated incentive scheme, including increasing local value-added, expanding production volumes, attracting new investments, meeting environmental standards, and supporting development in priority regions.

To qualify, manufacturers must produce at least 10,000 fossil-fuel vehicles annually, with a minimum of 5,000 units per model and local content starting at 20%, subject to biennial review. For electric vehicles, initial production must be at least 1,000 units, increasing to 7,000 by the end of the programme, with a starting local content of 10%, reviewed annually.

Electric vehicles will receive 50% of the incentives linked to value-added and production volume and full incentives for new investment and environmental compliance.

The maximum eligible car price is EGP 1.25m, with an engine size limit of 1600cc. Incentives are capped at 30% of the ex-factory price, up to EGP 150,000 per vehicle. Gas-powered vehicles must receive environmental compliance certification from an entity affiliated with the Ministry of Petroleum.

To count as local content, at least 25% of the value must derive from genuine manufacturing or locally sourced components—not mere assembly. Both production and local content targets will rise over the programme’s seven-year span. Incentives will be partially reduced if targets are missed, while manufacturers exceeding 35% local content will receive an additional EGP 5,000 for every 1% increase, beyond the capped amount.

In priority development zones, companies producing over 100,000 fossil-fuel vehicles or 10,000 electric vehicles will be eligible for land cost reimbursement.

These benefits complement existing customs and tax incentives granted under multiple legislations, including those governing customs duties, special economic zones, SMEs, VAT, property tax, and investment.

Exporting companies may also benefit, as incentives are calculated based on total production, regardless of market destination. Additional bonuses will be awarded to firms that exceed programme targets.

The new incentive calculation methodology, including examples, was explained during the meeting.

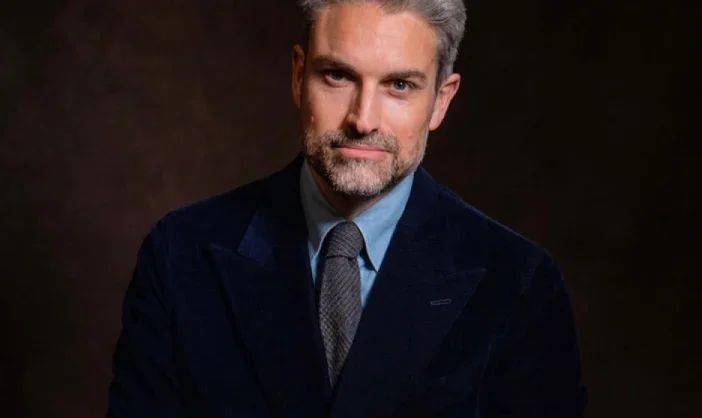

Minister of Investment and Foreign Trade Hassan El-Khatib reiterated that the revised programme aims to establish a genuine automotive manufacturing base in Egypt. He pointed to the country’s competitive advantages and said the amendments reflect the government’s ambition to scale up both vehicle and component production.

The Deputy Minister of Finance clarified that the incentives would be applied through a tax and customs offset mechanism, allowing manufacturers to use earned entitlements to settle dues, thereby streamlining the process.

Some component producers called for strengthening the local supply chain—particularly for steel and panel materials used in car bodies—to reduce reliance on imports. In response, Al-Wazir directed that all producers of these materials be invited free of charge to a reverse exhibition to be held alongside the upcoming Industry and Transport Exhibition, which will link automakers with raw material suppliers to spur the growth of Egypt’s automotive and electric vehicle sectors.

Several vehicle manufacturers raised concerns about the need to ensure fair competition between locally assembled electric vehicles—which face import duties on components—and fully built electric vehicles that enter tariff-free. They also called for a reassessment of customs duties on production inputs. It was confirmed that these matters will be studied by the Ministries of Investment, Foreign Trade, and Finance to support local industry, particularly electric vehicle manufacturers.